colorado electric vehicle tax credit 2020 form

Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. Make sure you ask the dealership about this option.

Oil Industry Cons About The Ev Tax Credit Nrdc

112017 112020 112021 112023 but prior to.

. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy Office at mattminesstatecous or 3038662128. The current iteration offering up to 5000 in tax credits dropped to 4000 in January and will be reduced again to 2500 next year.

New EV and PHEV buyers can claim a 5000 credit on their income tax return. November 17 2020 by electricridecolorado. Examples of electric vehicles include.

If you lease an electric vehicle for two years beginning from 2021-2023 you can get a 2000 tax credit. DR 1316 - Colorado Source Capital Gain. Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a.

Examples of electric vehicles include. The credits which began phasing out in January will expire by Jan. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit.

If you purchased your ev more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to claim your credit. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

THE COLORADO ENERGY OFFICE CANNOT PROVIDE ANY TAX-RELATED ADVICE. It is a great resource for anyone seeking information on vehicle electrification in Colorado. DR 0350 - First-Time Home Buyer Savings Account Interest Deduction.

To claim your tax. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. DR 0346 - Hunger Relief Food Contribution Credit.

One of Governor Polis first executive orders Executive Order B 2019 002 Supporting a Transition to Zero Emission Vehicles includes supporting the acceleration of widespread electrification of cars buses and trucks and adopting the goal of 940000 light-duty electric vehicles in Colorado by 2030. Many leased EVs also qualify for a credit of 2000 this. The tax credit for most innovative fuel.

I am completing Form 8936 for a 2019 Tesla purchase to receive the electric vehicle credit. The dashboard allows people to view information on EV deployment current statewide EV infrastructure and details on charging use for a selected number of stations. Contact the Colorado Department of Revenue at 3032387378.

For additional information consult a dealership or this Legislative Council Staff Issue Brief. DR 0375 - Credit for Employer Paid Leave of Absence for Live Organ Donation Affidavit. You can claim the Colorado Electric Vehicle Tax Credit for yourself on your tax return or use it at the dealership to lower the sticker price of the vehicle you want to purchase.

And improve the safety of Colorados transportation network. DR 0366 - Rural Frontier Health Care Preceptor Credit. If you claim the Colorado Electric Vehicle Tax Credit for yourself you need to file a Colorado income tax return Form DR 0617 and a copy of the lease or purchase agreement.

Colorado electric vehicle tax credit form. Ad Free For Simple. 112020 112021 112023 112026 Classification Gross Vehicle Weight Rating GVWR Light duty passenger vehicle NA 5000 4000 2500 2000.

Hybrid electric vehicles and trucks Manufactured and converted electric and plug-in hybrid electric motor vehicles and trucks that are propelled to a significant extent by an electric motor that has a battery capacity of at least 4 kWh and is capable of being recharged from an external power source CNG LNG LPG or hydrogen vehicles. In 2018 Colorado released its first electric vehicle EV. The credit is worth up to 5000 for passenger vehicles and more for trucks.

Colorado Tax Credits. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. Colorado EV Plan 2020.

After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online. To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles.

Colorados tax credits for EV purchases. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. 17 hours agoIf a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

A number of bills affecting electric vehicle adoption in Colorado were considered during the 2019 session. Please visit TaxColoradogov prior to completing this form to review. Save time and file online.

Tax Year 2020 Instructions DR 0617 081720 DONOTSEND COLORADO DEPARTMENT OF REVENUE Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle. If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. Filemytaxes november 1 2021 tax credits.

DR 0347 - Child Care Expenses Tax Credit. If you claim the Colorado. CEO and Atlas Public Policy will continue to refine this dashboard over time.

Credit Amounts for Purchases of Qualifying Electric and Plug-in Hybrid Electric Vehicles and Trucks Tax year beginning on or after. DONOTSEND DR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov Innovative Motor Vehicle Credit and Innovative Truck Credit Tax Year 2021 Instructions Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle. You may use the Departments free e-file service Revenue Online to file your state income tax.

You do not need to login to Revenue Online to File a Return. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Oil Industry Cons About The Ev Tax Credit Nrdc

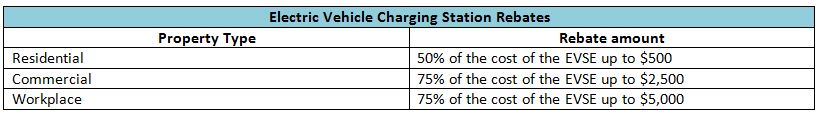

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ford Focus Electric Tax Credit Off 75

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicles Charge Ahead In Statehouses Minnesota Reformer

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

/https://www.forbes.com/wheels/wp-content/uploads/2020/09/2021-VW-ID.4-beauty.png)

Volkswagen S 2021 All Electric Id 4 Is Gunning For Gas Powered Rivals Forbes Wheels

Economy Wide Goals For Reducing Carbon Emissions In Colorado Western Resource Advocates

Ford Focus Electric Tax Credit Off 75

Rebates And Tax Credits For Electric Vehicle Charging Stations

What Is The Electric Vehicle Tax Credit

Rebates And Tax Credits For Electric Vehicle Charging Stations

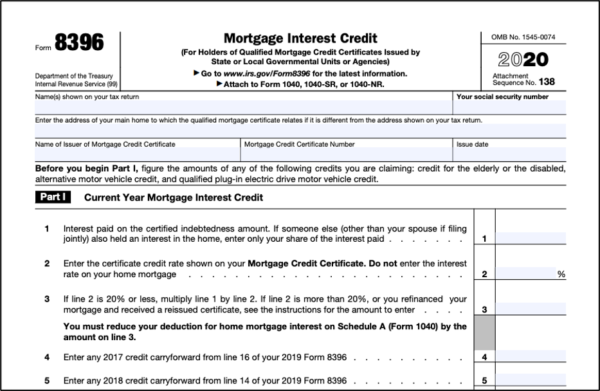

What Is A Mortgage Credit Certificate Mcc And Are They Worth It

What Is A Hybrid Car Tax Credit

Ford Focus Electric Tax Credit Off 75

Electric Car Tax Credit What Is Form 8834 Turbotax Tax Tips Videos

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age